9 Ways to Get Huge Tax Credits

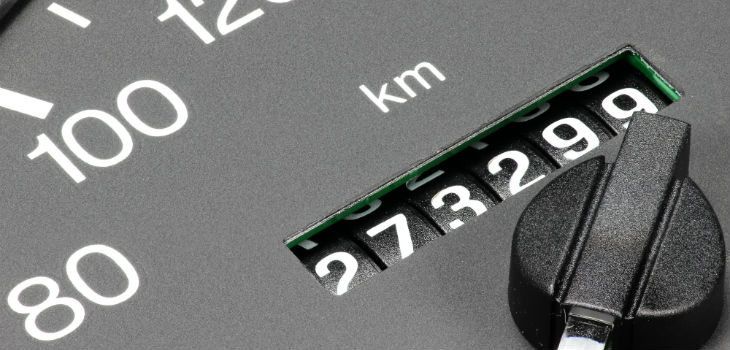

8) Track Your Mileage

Work-related driving and mileage deduction as well as other business expenses can add up and be qualified for savings on your tax return. Business travel while using your own vehicle can account for 51 cents per mile between the first of the year through the end of June, while 55.5 cents per mile can be accounted for between the beginning of July until the end of the tax year. Other forms of mileage eligible include travel for medical purposes as well as moving or relocation. Travel regarding charity and donations can even be tracked to account for up to 16 cents per mile. For employees who commute to work on a daily basis or use their vehicle while on the job, logging information such as fuel purchases, mileage, and maintenance can go an exceptionally long way as well as help the vehicle ultimately pay for itself.